Copyright © 2023

WIKINAM ICT Services Cc

Proudly Namibian

CLOSE ADVERTISEMENT

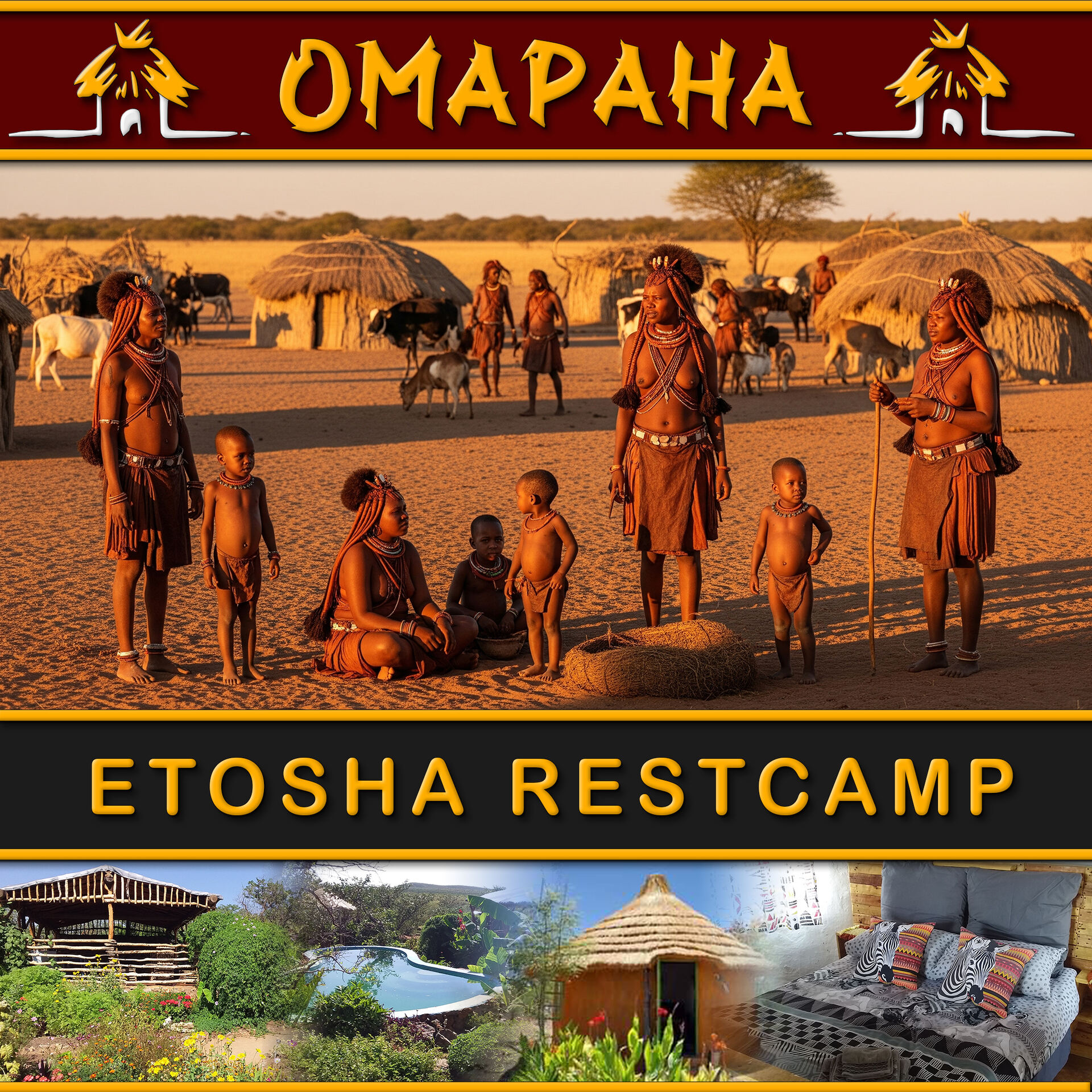

- Omapaha Etosha Restcamp

- Business Category: Accommodation (Camping, Lodge, General), Tour & Safari Operators in Outjo/Etosha, Namibia

-

- Situated within the breathtaking landscapes of Farm Vierling near Etosha National Park, Omapaha Etosha Himba Village offers visitors a rare chance to experience the traditions and lifestyle of the Himba people. Closely affiliated with the Otjikandero Himba Orphan Village, Omapaha serves as both a cultural hub and a sanctuary for 15 orphaned children, ensuring the preservation of the Himba heritage while adapting to modern challenges.

- A visit to Omapaha Etosha Himba Village is more than just a trip—it is an opportunity to engage with one of Africa’s most fascinating communities, contribute to their well-being, and leave with unforgettable memories.